Building a Strong Defense Against Fraud

Sep 30, 2024 By Elva Flynn

Fraud is a big danger to businesses that work in different solution channels. With changes in technology, fraudsters also find new ways for their activities. A multi-layered strategy against fraud brings together several techniques and tactics to make a strong protection system. This article is going to look into the successful application of a multi-layered fraud strategy made specifically for business solutions channels. It will highlight different methods of preventing fraud that can secure your operations and strengthen your general security position.

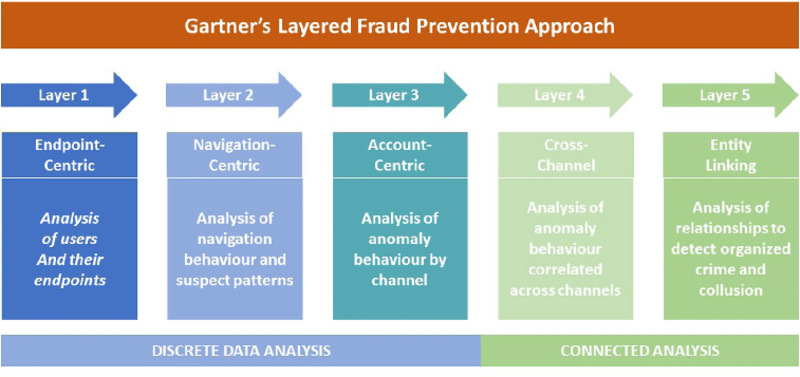

Understanding Layered Fraud Strategy

A type of fraud strategy that is multi-layered uses different techniques for preventing fraud. These methods work in sync to form a complete framework for security. This approach understands that no one method can successfully fight against every attempt at fraud. Instead, it employs numerous defenses arranged on top of each other to improve resistance against threats that are continuously changing and evolving. This method is very important in business solutions channels. Here, various transaction forms and customer interactions can show different weak points. Using a mix of technologies, processes, and human monitoring allows businesses to identify fraud incidents more effectively, stop them from happening, and deal with them when they occur.

A layered fraud strategy is good based on how it can mix different fraud detection and prevention technologies. Things like artificial intelligence and big data analytics give more understanding of user behavior and transaction patterns, making it possible to change the fraud prevention structure in real-time. Using these kinds of tech keeps businesses one step ahead of those who commit fraud because they keep changing their ways all the time.

- Integration Capability: Ensure all technologies can work together to provide a unified defense.

- User Experience: Consider the impact of security measures on legitimate customers to maintain a positive experience.

Identifying Vulnerabilities in Business Solutions Channels

The initial phase of applying a multi-layered fraud strategy involves recognizing the weaknesses inherent to your business solutions channels. It's important to grasp various interaction points where transactions take place, for example, online payments, account access, and data exchange. Performing an in-depth risk evaluation can assist in identifying places prone to fraud. For this evaluation, it's necessary to look at transaction trends, how users behave, and logs of system access. Recognizing weak points permits companies to customize their techniques for preventing fraudulent activities so they can successfully handle particular threats. Businesses should perform vulnerability assessments regularly for them to adapt whenever new dangers come up.

Additionally, companies must think about internal and external risks when finding weak spots. Threats from the outside often include complex plans by skilled deceivers, whereas inside threats may come from workers who have access to confidential information. A thorough analysis of weakness covers both sorts to develop a well-balanced strategy for preventing fraud.

- Cross-Channel Analysis: Assess vulnerabilities across different channels for a complete view of potential risks.

- Employee Roles: Be mindful of employees' access levels and potential insider threats when evaluating vulnerabilities.

Implementing Technology Solutions

Integrating technology solutions is a key part of a structured fraud strategy. High-level fraud detection instruments can study transaction information instantly to point out anything abnormal or suspicious. Machine learning formulas may be used for increasing the ability to detect, as they continuously learn from new data thereby making accurate results better over time. Biometric confirmation, double-factor confirmation, and tokenization are effective tools that can insert extra safety layers into transactions. When these technologies mix into present systems, businesses get the opportunity to enhance their protection against fraud and decrease possible damages to their operations.

Although technology is important, choosing the correct tools adapted to particular business requirements is necessary. Not all solutions are suitable for every type of business and it's key to understand which technologies give the most valuable return on investment. Regular checks on how effective these technologies can assist businesses in staying one step ahead in fraud risks and adjusting their resources appropriately.

- Scalability: Ensure that technology solutions can grow with your business to accommodate increasing transaction volumes.

- Vendor Reliability: Choose reputable technology vendors with proven track records in fraud prevention.

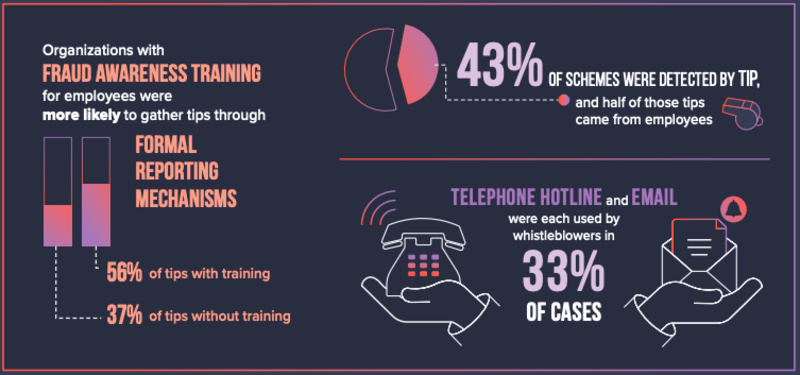

Training Employees on Fraud Awareness

Even though technology is highly significant in stopping fraud, the role of human supervision also holds equal importance. It's necessary to give employees proper training about being alert to fraud to create a work culture that gives priority to safety within the company or organization. Employees need education about the usual tricks used by those committing fraudulent acts like phishing and social engineering so they can identify threats when exposed. Promoting workers to inform them about doubtful actions and offering them the methods for this can build an extra level of safeguarding. Constant lessons and news on new trends in scams can maintain worker knowledge and watchfulness, decreasing the chance of fraud activities succeeding.

Continuing education programs must incorporate imitation fraud cases so staff can learn how to spot and deal with risks. This practical way might enhance memory of details and ready the personnel more effectively for understanding real events. Regular checks on workers' awareness could assist in finding out what they don't know yet or where they need enhancement.

- Engagement Methods: Use interactive training tools to keep employees engaged and informed about fraud threats.

- Feedback Loop: Establish a system for employees to share their insights on fraud experiences and learnings.

Establishing Clear Policies and Procedures

For a layered fraud strategy to work, there must be clear rules and methods. Companies need to make instructions for dealing with business deals, keeping an eye on unusual actions, and reacting when possible fraud situations may happen. This system should explain the duties and tasks of workers who participate in stopping fraudulent activities. Moreover, setting up rules for reporting and examining possible fraud can make the response procedure more efficient. Transparent communication about these policies helps guarantee that every employee knows what they must do to protect our business from any fraudulent activities.

Usually, we need to check and renew these policies often because of changes in rules, technologies, or the way our business works. Being flexible helps our company stay within legal limits and deal with new problems efficiently. If we include employees when creating policies it can help them feel like they have a part in preventing dishonest actions.

- Documentation Standards: Maintain thorough documentation of all policies to ensure clarity and consistency.

- Legal Compliance: Stay informed about relevant laws and regulations to ensure all policies adhere to legal standards.

Monitoring and Adapting Strategies

Ongoing observation and adjustment of methods to prevent fraud are important parts of a multilayered approach to the fight against scams. Companies must frequently examine their measures for detecting deceptive activities as well as incident records, so they can notice patterns and change strategies if necessary. Evaluating how effective the techniques put into practice have been will enable companies to fine-tune their plan and tackle any weaknesses in protection systems. Keeping updated on new fraudulent methods and advancing technologies guarantees that your multi-level fraud strategy continues to be efficient and pertinent despite the presence of fresh obstacles.

Interacting with professionals in the field and joining discussions focused on fraud prevention can offer an important understanding of top methods and the latest tech tools. Creating collaborations with different companies might aid knowledge exchange, assisting firms to gain from each other's experiences and improve their efforts against fraud.

- Industry Trends: Keep abreast of the latest fraud trends and technologies to continuously improve your strategy.

- Feedback Mechanism: Implement a system for collecting feedback on fraud incidents to refine response strategies.

Conclusion

Finally, a multi-level scam plan is crucial for shielding business solutions channels from developing fraud dangers. By spotting weak points, applying tech fixes, educating workers, setting up obvious rules and persistently observing tactics, businesses can build an all-encompassing shield against deception. This forward-thinking method not only guards operations but strengthens customer faithfulness and loyalty in a growing complex digital environment.

-

Business Sep 29, 2024

Business Sep 29, 2024The Importance of Financial Support in Local Communities

Discover the way the Farmers and Merchants Grant Program is helping businesses in Long Beach and improving effects on the community.

-

FinTech Sep 08, 2024

FinTech Sep 08, 2024Hybrid Agencies: Managing Remote Work and Global Teams Effectively

A hybrid agency offers flexible marketing services that are suited to each client's needs by combining the knowledge of in-house and outside experts.

-

Currency Jan 09, 2024

Currency Jan 09, 2024What is Accounts Receivable Financing?

Accounts receivable financing is the agreement that allows business owners to access financing capital related to their accounts receivable. AR Financing agreements can be structured with asset sales or loans. This financing business is a great way to free up the business's cash flow, tied up by unpaid invoices.

-

Currency Oct 21, 2024

Currency Oct 21, 2024Forex Trading in 2024: Identifying and Mitigating Key Risks

Delve into the essential forex risks traders encounter in 2024. Gain insights into effective risk management techniques to enhance your trading strategy and profitability