The Importance of Financial Support in Local Communities

Sep 29, 2024 By Georgia Vincent

In the last few years, giving financial assistance to local businesses has become more and more important for encouraging economic strength and growth in communities. The Farmers & Merchants Grant Program is a big step towards this goal in Long Beach, offering much-needed resources to small businesses that usually find it hard to do well due to intense competition. This article looks at the aims of this program, its effect on community members of Long Beach, and how it aids people in running their businesses locally.

Overview of the Farmers & Merchants Grant Program

This program called Farmers & Merchants Grant Program was set up to assist small businesses in Long Beach. Its objective is to boost economic growth and improve the local business environment. The scheme provides financial aid to suitable businesses, giving them a chance to handle different operational problems, put resources into new technology, or develop their services further. The main goal of this program is to strengthen entrepreneurs and secure their ongoing survival within the community.

This program is made to adjust according to the fluctuating requirements of businesses in the Long Beach area. By regularly assessing the impact of its funding, it can perfect what it offers so that the local entrepreneurial landscape gets more benefits. This flexibility not only makes it perform better but also promotes an environment for innovation among those participating.

- Caution: Funds must be utilized within specified timeframes to ensure compliance.

- Noteworthy: Ongoing assessments help tailor the program to evolving business needs.

How the Program Benefits Local Businesses

The Farmer & Merchant Grant Program's financial aid has a direct effect on local enterprises. Those qualified to receive this can spend the money on various needs like refurbishing, promoting strategies, and taking in new staff members. This backing allows them to better their business workings and upgrade the services they give out. So, several local business owners have told about a growth in their income and client communication after taking part in the program.

Besides quick monetary gains, the program motivates nearby companies to make lasting plans for expansion. People taking part frequently understand top methods via workshops and meetings that go hand-in-hand with the grant money. This comprehensive method improves their ability to handle upcoming difficulties.

- Consideration: Engage with other businesses to share resources and knowledge.

- Fact: Many grant recipients report improvements in customer satisfaction after funding.

Long Beach Community Impact

The effect of the program is not only limited to single businesses but also impacts the wider community of Long Beach. Through putting money into local firms, The Farmers & Merchants Grant Program encourages job creation and supports maintaining a healthy local economy. When these businesses do well, they add to the general vitality of the community by providing jobs and increasing local tax income. This ripple effect is essential for maintaining a robust economic environment in Long Beach.

You can see the good effects of this program in how community development plans come from businesses that do well. These businesses usually give back to their local area and help with projects as they get bigger, making Long Beach's social life richer. This kind of close relationship shows why looking after our own small companies is so crucial for everyone living here on a broader scale.

- Caution: Monitor community engagement as businesses grow to maintain a positive impact.

- Noteworthy: Thriving businesses often lead to increased community investment in local projects.

Success Stories from Local Entrepreneurs

Various business owners in Long Beach have effectively used the Farmers & Merchants Grant Program to expand their enterprises. To illustrate, one caf owner locally employed grant money for refurbishing his place, which led to a rise in people coming and more total sales. Another beneficiary who owns a boutique directed the given funds into an online marketing drive that greatly improved her virtual presence and client interaction. These success stories highlight the programs effectiveness in transforming challenges into opportunities for growth.

These instances show the various methods by which companies can utilize grant funds to fulfill their specific requirements. Apart from monetary aid, a lot of business owners express that they gain self-assurance and feel part of a community due to their participation in this initiative. This supportive network holds great importance for encouraging entrepreneurship within Long Beach.

- Consideration: Seek mentorship opportunities to maximize the benefits of the grant.

- Fact: Many grant recipients have expanded their customer base significantly.

Challenges Faced by Small Businesses in Long Beach

While the Farmers & Merchants Grant Program has good effects, many small businesses in Long Beach still struggle. Things like high rents, bigger competitors, and changes in what customers want are problems for local business people. This program is very important because it helps to reduce some of these difficulties by giving necessary financial help that allows businesses to adjust and succeed even when market conditions change.

To solve these difficulties, companies generally have to think differently and discover new methods to interact with clients. The grant scheme supports this attitude, motivating business people to not just endure but also flourish by investigating fresh paths for expansion. Accepting alterations is very important in a changing marketplace.

- Caution: Stay informed about market trends to remain competitive.

- Noteworthy: Regularly reassess business strategies to adapt to changing consumer needs.

Future of the Farmers & Merchants Grant Program

In the future, the Farmers & Merchants Grant Program is planning to widen its scope and influence. The program's goal is to draw interest from a variety of applicants in different sectors as more businesses get knowledge about available resources. Ongoing partnerships with leaders of local business communities will be crucial for assuring the success and ongoing operation of this program. The continuous dedication to back up local business owners is still a core principle of the program's objective.

The program, as it develops, could include fresh technologies and ways of funding to improve its efficiency. Concentrating on innovation and change could keep the Farmers & Merchants Grant Program vital in strengthening Long Beach's economic environment. How this plan goes forward might depend a lot on how well it can stay significant in an evolving market scene.

- Consideration: Regular feedback from participants can guide future program enhancements.

- Fact: Community collaboration can amplify the programs overall impact.

Conclusion

The Grant Program from Farmers & Merchants has contributed significantly to the lives of many business persons in Long Beach. They give money to help businesses founded locally, making the community strong and helping build a thriving economic scene. The ongoing achievement of this plan underlines the value of such plans in supporting endurance and development within local economies. As Long Beach progresses, the effect of the Farmers & Merchants Grant Program will surely keep echoing across our society.

-

Business Oct 24, 2024

Business Oct 24, 2024Prepare for a Business Loan Meeting: Tips for Success

This article provides a detailed guide on how to confidently approach your lender for a business loan. Learn how to prepare, what documents to bring, and how to present your business plan to increase your chances of securing the loan. Tips include organizing your financials, improving your personal credit, and offering collateral to back your request.

-

Savings Sep 23, 2024

Savings Sep 23, 2024Secure Your Health: Steps to Establish a Medical Emergency Fund

Learn how to build a medical emergency fund, assess healthcare costs, and create a savings plan for a secure financial future during unexpected medical situations.

-

Currency Jan 09, 2024

Currency Jan 09, 2024What is Accounts Receivable Financing?

Accounts receivable financing is the agreement that allows business owners to access financing capital related to their accounts receivable. AR Financing agreements can be structured with asset sales or loans. This financing business is a great way to free up the business's cash flow, tied up by unpaid invoices.

-

Currency Oct 21, 2024

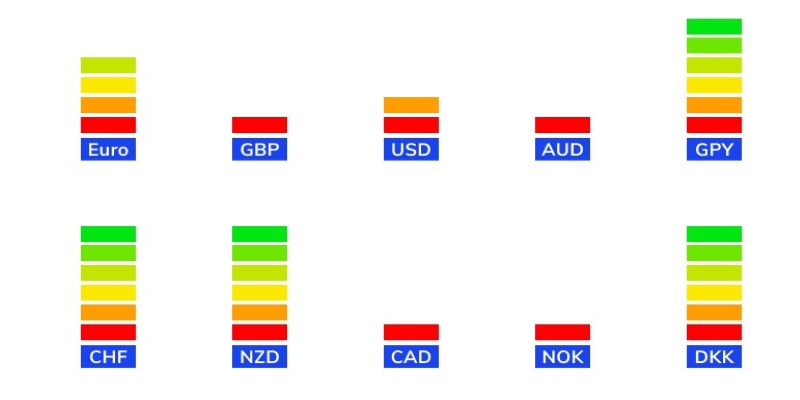

Currency Oct 21, 2024Forex Made Simple: How to Harness the Power of a Currency Strength Meter

How to use a currency strength meter to improve your Forex trading. Discover the tool’s benefits, how it works, and practical tips for incorporating it into your strategy