Secure Your Health: Steps to Establish a Medical Emergency Fund

Sep 23, 2024 By Triston Martin

In today's unpredictable world, having a medical emergency fund is not just a prudent choice but a necessary safeguard for your health and financial well-being. Medical emergencies can arise unexpectedly, often leaving individuals and families grappling with staggering medical bills and the stress that accompanies them. By establishing a dedicated fund for such unforeseen expenses, you can ensure that you are prepared to handle health-related crises without derailing your financial stability. This proactive approach not only provides peace of mind but also empowers you to focus on recovery rather than worrying about the fiscal implications of medical care. In the following sections, we will explore practical steps to help you effectively create and manage your medical emergency fund, ensuring a healthier, more secure future.

Assess Your Healthcare Costs

The first step in building a medical emergency fund is to thoroughly assess your healthcare costs. Take the time to evaluate both your routine medical expenses and potential out-of-pocket costs that could arise from unexpected situations. Start by reviewing your monthly bills, including insurance premiums, copayments, and any ongoing prescriptions. Additionally, factor in the cost of annual check-ups and preventive care.

Its also essential to consider variables such as deductibles, emergency room visits, or specialist fees, which can significantly impact your financial landscape in a crisis. Understanding your healthcare expenses will provide you with a clearer picture of how much you need to save and allow you to set realistic goals for your medical emergency fund.

Set a Savings Goal

Once you have assessed your healthcare costs, it's time to define a savings goal for your medical emergency fund. It's advisable to have at least six months' worth of living expenses saved in your emergency fund, including healthcare-related costs. However, this amount can vary depending on individual circumstances. A single person with no dependents may need less than a family with children or older adults with chronic illnesses.

Factors to Consider When Setting a Goal

When setting a savings goal for your medical emergency fund, it's crucial to take into account your family size and health history.

- Family Size: The number of dependents in your household can dramatically influence your healthcare costs. Larger families typically face higher medical expenses due to increased routine visits, vaccinations for children, and the potential need for more extensive medical care. Consider the specific needs of each family member, as children and elderly individuals may have higher healthcare requirements.

- Health History: Your family's medical history plays a significant role in determining potential healthcare expenses. If there are chronic conditions or hereditary illnesses prevalent within your family, its wise to anticipate associated costseven if they are not currently an issue. Additionally, personal health conditions, such as diabetes or heart issues, should be factored into your savings goal, as these may require ongoing treatment, frequent doctor's visits, and prescription medications.

By carefully evaluating these factors, you can set a more accurate and realistic savings target that will prepare you for future medical emergencies.

Create a Dedicated Savings Account

Establishing a dedicated savings account for your medical emergency fund is a vital step in ensuring that your savings remain untouched for other expenses. Choose a high-yield savings account or a money market account that offers better interest rates than traditional savings accounts, allowing your funds to grow over time while remaining easily accessible in case of emergencies.

When setting up this account, be sure to keep it separate from your regular checking and savings accounts to prevent the temptation to dip into these funds for non-emergency-related purchases. Additionally, consider automating your contributions to this account through direct deposits or scheduled transfers from your primary account. This method not only helps in building your fund consistently but also takes the effort out of manual savings, reinforcing your commitment to securing your financial health. Regularly review your savings growth and adjust your contributions as needed, ensuring that you stay on track to meet your established savings goal.

Establish a Regular Savings Plan

Creating a regular savings plan is crucial for the success of your medical emergency fund. Consistency in contributions will help you reach your savings goal more effectively. Start by determining how much money you can allocate monthly towards your medical emergency fund. This amount should be based on your overall budget, taking into account your essential expenses and discretionary spending.

Implementing Your Savings Plan

To implement your savings plan, consider breaking down your annual savings goal into manageable monthly contributions. For example, if you aim to save $6,000 within a year, you would need to set aside $500 each month. Consider utilizing automated transfers from your checking account to your dedicated savings account. This "pay yourself first" strategy ensures that your savings are prioritized and removes the temptation to spend the funds elsewhere.

Regularly Reassess Your Contributions

As your financial situation evolves, it's important to periodically reassess your savings contributions. Changes in income, family circumstances, or healthcare needs may require adjustments to your plan. Aim to review your savings plan every six months and adjust your contributions accordingly, ensuring that you remain on track to achieve your medical emergency fund goals.

Conclusion

Building a medical emergency fund is an essential step in securing your financial health and ensuring peace of mind during unexpected medical situations. By assessing your healthcare costs, setting a realistic savings goal, creating a dedicated savings account, and implementing a regular savings plan, you can be better prepared to face any potential medical emergencies that may arise. Remember to regularly reassess your contributions and adjust as needed to stay on track towards achieving your financial goals. With these steps in place, you can rest assured that you are taking proactive measures towards a healthier, more secure future for yourself and your loved ones.

-

Business Sep 29, 2024

Business Sep 29, 2024Strategies for Online Business Growth

Uncover key strategies to enhance your online business growth and effective digital marketing techniques.

-

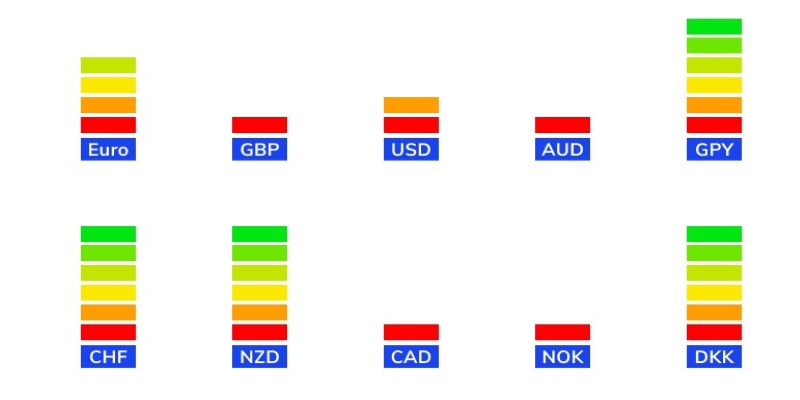

Currency Oct 21, 2024

Currency Oct 21, 2024Forex Made Simple: How to Harness the Power of a Currency Strength Meter

How to use a currency strength meter to improve your Forex trading. Discover the tool’s benefits, how it works, and practical tips for incorporating it into your strategy

-

Savings Sep 23, 2024

Savings Sep 23, 2024Stay Afloat: 6 Smart Do's and Don'ts for Saving Money During a Recession

Discover effective strategies to save money, increase income, and maintain financial stability during a recession. Prioritize smart decisions and self-care for long-term resilience.

-

Business Sep 02, 2024

Business Sep 02, 202450+ Essential Interview Questions to Evaluate Potential Candidates

Interviewers need to ask essential questions to interview someone and hire the best potential candidate for their company’s vacant job position.