Predicting Forex Reversals with Harmonic Patterns: A Comprehensive Guide

Oct 20, 2024 By Vicky Louisa

Imagine having a roadmap to predict market reversals before they happensounds ideal, right? That's exactly what harmonic patterns offer in forex trading. These geometric price formations, grounded in Fibonacci retracement ratios, give traders a framework to forecast market movements with uncanny precision.

While mastering them takes practice and patience, the potential payoff can be huge. In this guide, we'll break down the most popular harmonic patterns and show you how to integrate them into your trading strategy, so you can make smarter, more confident decisions in the volatile world of forex trading.

What are Harmonic Patterns?

Harmonic patterns are a type of price pattern used in technical analysis, relying heavily on Fibonacci ratios to predict future price movements. These patterns represent geometric shapes formed by price waves in the market and are based on the belief that price movements are repetitive and structured. The precision of harmonic patterns sets them apart from more traditional chart patterns like triangles or head and shoulders, as they rely on strict rules regarding retracement and extension levels.

Harmonic patterns are deeply rooted in Fibonacci ratios, which appear frequently in nature, art, and, as traders believe, in financial markets. These ratios, such as 61.8%, 78.6%, and 88.6%, define the size of price retracements and extensions that form harmonic patterns. By analyzing these retracements, traders can spot potential reversal points, helping them predict the next movement in the market.

Key Types of Harmonic Patterns

Harmonic patterns are valuable tools in forex trading. They offer insight into potential market reversals by relying on precise Fibonacci ratios. Several harmonic patterns are commonly used, each providing specific signals for traders.

The Gartley Pattern

The Gartley pattern is one of the most well-known harmonic patterns, created by H.M. Gartley. It features five points labeled X, A, B, C, and D, forming a structure that indicates a trend reversal. In this pattern, the AB leg retraces 61.8% of XA, while point D completes the pattern with a 78.6% retracement of XA. At point D, traders often anticipate a reversal in price, making it a prime entry point.

The Butterfly Pattern

The Butterfly pattern, developed by Bryce Gilmore, also indicates trend reversals but differs from the Gartley in that point D extends beyond the original X point. This makes the Butterfly pattern useful in identifying reversals at the extremes of market movement. It uses a 78.6% retracement of XA for the AB leg and an extension of up to 161.8% for CD, signaling strong reversals.

The Bat Pattern

Introduced by Scott Carney, the Bat pattern is known for its deep retracements, which are more precise than the Gartley. The B point retraces 38.2% to 50% of the XA leg, while point D finishes at an 88.6% retracement of XA. The Bat pattern often results in accurate trend reversals at point D, giving traders a strong signal to enter a trade.

The Crab Pattern

The Crab pattern, another discovery of Scott Carney, is considered one of the most accurate harmonic patterns. The pattern allows traders to enter trades at extreme price levels, with AB retracing 38.2% to 61.8% of XA, and CD extending to 161.8% or more. Point D is the reversal point, offering an ideal opportunity for traders to capitalize on sharp price changes.

The Shark Pattern

A newer addition to harmonic trading, the Shark pattern is distinguished by sharp price movements and unique Fibonacci ratios. AB extends between 113% and 161.8% of XA, while point D signals the potential for a strong reversal. This pattern is often used by traders looking to profit from sudden market shifts.

The ABCD Pattern

The ABCD pattern is the simplest harmonic pattern, consisting of two equal legs, AB and CD, with a retracement (BC) in between. The retracement in BC is typically 61.8% or 78.6% of AB, and CD often extends to 127.2% of BC. Point D signals the end of the pattern, where traders anticipate a reversal.

How to Trade Harmonic Patterns?

Once youve identified a valid harmonic pattern, trading it involves three key steps: entry, stop-loss, and take-profit.

Entry: Traders typically enter a trade at point D, where the pattern completes. At this point, a reversal is expected, and its time to either go long (buy) in a bullish pattern or go short (sell) in a bearish pattern.

Stop-Loss: Risk management is critical. Traders often place stop-loss orders just beyond point D to limit their potential losses if the market doesnt reverse as expected.

Take-Profit: Take-profit targets are often set using Fibonacci extension levels, such as 127.2% or 161.8% of the CD leg. These targets provide a systematic way to exit trades once the market moves in the anticipated direction.

Advantages and Limitations of Harmonic Patterns

The primary advantage of harmonic patterns is their precision, as they rely on Fibonacci ratios to define clear entry and exit points. This mathematical structure provides a systematic approach to forex trading, making harmonic patterns appealing to experienced traders who seek accuracy in timing their trades. These patterns help traders anticipate market reversals and manage risks effectively.

However, one of the main challenges of using harmonic patterns is their strict formation rules, which can make them difficult to spot in real-time. Patterns may not always align perfectly with their Fibonacci ratios, requiring patience and careful analysis. Furthermore, harmonic patterns can be less reliable in highly volatile markets, as sudden price movements can distort the retracement and extension levels, reducing their effectiveness in such environments.

Conclusion

Harmonic patterns offer forex traders a powerful tool to predict market reversals and make informed trades. While they require attention to detail and strict adherence to Fibonacci ratios, the reward can be significant when patterns are completed correctly.

Whether youre spotting a Gartley or Crab pattern, the key lies in understanding how these shapes form and how to use them to your advantage. By combining harmonic patterns with other technical analysis tools, traders can boost their chances of success in the ever-volatile forex market.

-

Savings Sep 23, 2024

Savings Sep 23, 2024Secure Your Health: Steps to Establish a Medical Emergency Fund

Learn how to build a medical emergency fund, assess healthcare costs, and create a savings plan for a secure financial future during unexpected medical situations.

-

FinTech Nov 08, 2023

FinTech Nov 08, 2023Risks brought by artificial intelligence assistants

Consumers switch to new businesses for three main reasons, which include lower prices, more attractive products, and selfishness of artificial intelligence assistance.

-

FinTech Sep 08, 2024

FinTech Sep 08, 2024Boost Revenue with Sales Automation Tools: A Guide for Businesses

From managing leads to following up, sales automation tools make the whole process easier, increasing speed and cutting down on manual work.

-

Currency Oct 21, 2024

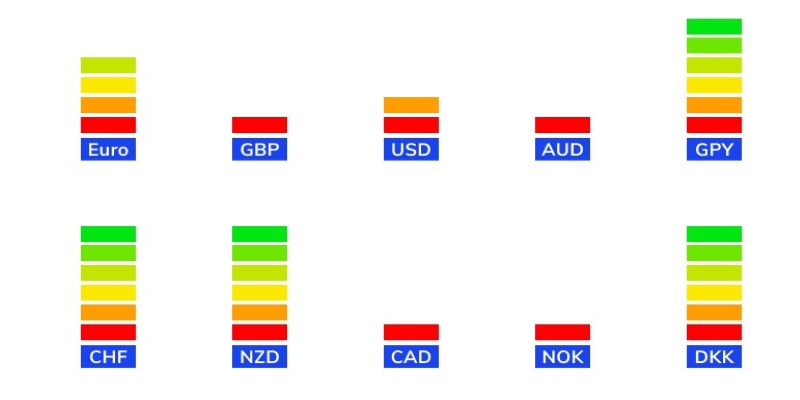

Currency Oct 21, 2024Forex Made Simple: How to Harness the Power of a Currency Strength Meter

How to use a currency strength meter to improve your Forex trading. Discover the tool’s benefits, how it works, and practical tips for incorporating it into your strategy