A Guide to Understand: How to Choose a Cryptocurrency Mining Pool

Jan 01, 2024 By Triston Martin

Introduction

Not all currencies are the same. Some are better to mine than others, even if you use the same hash power. Even if you choose the best pool for a certain best currencies, you won't make much if you mine a currency that isn't worth much.

In general, it's less financially beneficial to my old, well-known currencies with less need to have strong, but this isn't always the case. Like What to Mine, many online calculators can help you figure out.

So, after you search on Google and find a few pools for the currency you want to mine, do a little more searching and see what other miners have to say about these pools.

A pool's size is one of the most things to think about Cryptocurrency and its reputation. Most of the time, the greater is. The network of interconnected miners and, most importantly, the pool's hash rate are the two things that determine a pool's size. Small pools with only a few miners and a low hash rate don't make much more money than mining by yourself.

Bitcoin Mining Pool

The main thing to consider is the payments, which change depending on which payment model the mining pool uses. It shows who is taking the risk: the miners or the person running the mining pool. If the mining pool operator takes on the risk, the fees are higher. If the miners take on the risk, the fees are lower.

Most of the time, the fees range from 0% to 4%. The service fee for mining pools is 1 percent, so check out how it plays out and what other features it has if you find one with a higher fee. You should choose if the second pool has the same features and payment method as the first but has a lower fee.

There are times when a pool has no fee. It is very rare, and most of the time, it means you're dealing with a new pool that doesn't charge a fee to get people to join. On the other hand, some pools get their money from donations and other ways, so if you find one with a 0% fee, you should keep an eye on any changes.

Latency

Latency is the time it takes again for data users to send to the pool and back to come back to you. For the shares a mining client sends to the pool to be accepted, they have to arrive on time before the pool switches to mining the next block. If the share arrives too late because of a bad network, pools count it as "stale," which is usually worth less than an "accepted" share, and the miner gets less (or nothing) for it. The more and more network hops the data has to make to get to the pool, the more likely it is that the data will get "dropped" or lost in time. This can cause shares to be lost, either completely or because they have to be sent again, making them old.

Sonar can be used to check how far away you are from the pools' servers, and we also have a service called Stratu. Ms that acts as a middleman between the pool and the miner, directing traffic through an enterprise connection.

Difficulty

Last but not least is the difficulty, which would be a pool's internal setting for how much hash rate a solution must "be worth" to be considered a share and sent to the pool. If the difficulty is too great for smaller miners, the pool might not know how long you've been mining on it if the difficulty is too great. When a big miner sends too many shares, the network equipment may be too low. If you want to know more about deciding which types of shares to give out in your business, you can talk to a lawyer.

Conclusion

To stay competitive in a mining pool, you may need to buy expensive, specially trained gear. For understand how to choose a cryptocurrency Mining pools need to give out work fairly and be clear about how they work. Payout and fee plans are important because they can cut into your profits. The total computational power of a mining pool is more important than its shape, but the size of the pool can also help you figure out how reliable it is.

-

Currency Oct 21, 2024

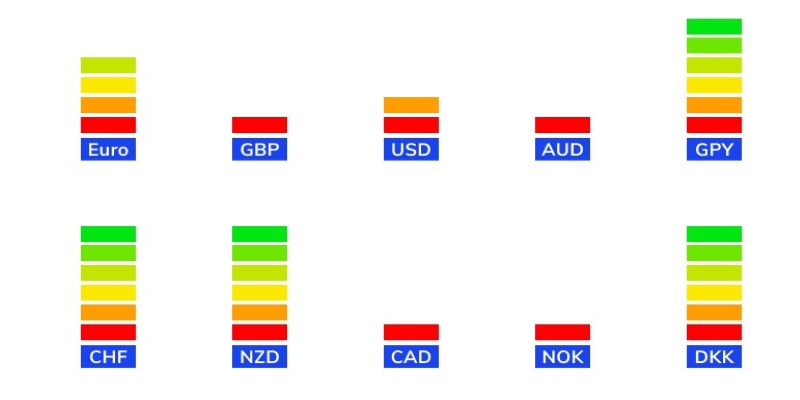

Currency Oct 21, 2024Forex Made Simple: How to Harness the Power of a Currency Strength Meter

How to use a currency strength meter to improve your Forex trading. Discover the tool’s benefits, how it works, and practical tips for incorporating it into your strategy

-

Business Sep 29, 2024

Business Sep 29, 2024Navigating Challenges in Small Business Operations

Discover how small businesses navigate challenges with resilience and effective strategies.

-

FinTech Oct 24, 2024

FinTech Oct 24, 2024Revolut's New Banking Era: What the License Means for Digital Banking

UK fintech firm Revolut secures its European banking license, allowing it to expand services across Europe. Discover how this milestone reshapes the company's future in digital banking

-

Business Sep 02, 2024

Business Sep 02, 202410 Lucrative Side Hustle Ideas You Can Start in 2024

Explore diverse side hustle ideas that boost your income, from tutoring to photography, while allowing you to pursue your passions and develop new skills.