Transforming Financial Services Through Technology

Sep 29, 2024 By Vicky Louisa

The financial sector is experiencing a major change, mainly because of the progress in artificial intelligence (AI). Banks and financial establishments are beginning to use AI technologies more and more. They find fresh strategies to improve service for customers through this. This article explores how AI changes financial services by focusing on personal banking solutions specifically, along with its total effect on customer happiness.

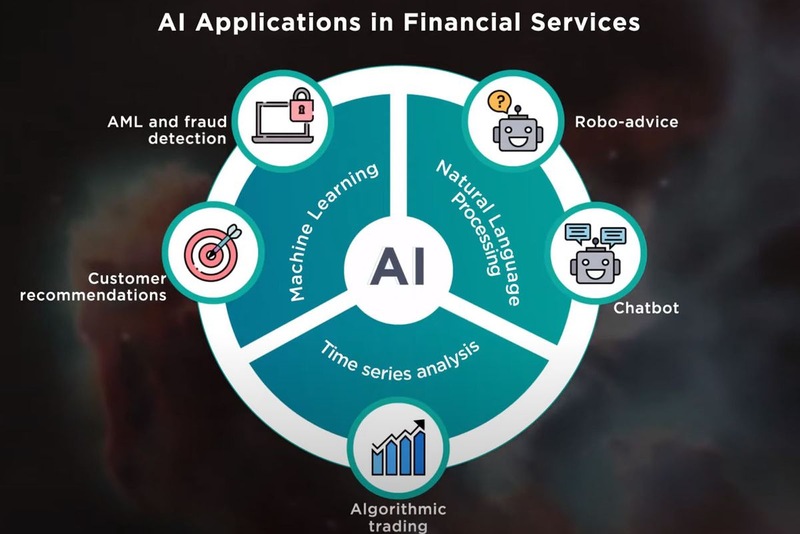

Understanding AI in Finance

AI includes various types of technology that let machines imitate the processes of human intelligence. In finance, such tech involves machine learning, understanding natural language, and predicting analytics. These advancements permit financial organizations to examine huge data quantities, recognize trends, and automate operations which in turn improves their service provision. Using AI, banks can make operations efficient, lessen expenses, and upgrade decision-making methods. This is advantageous for both the bank institution and its customers.

Knowing what AI can do is not just about automation, it also helps to improve understanding of customer needs. By looking at past data and current patterns, AI gives a deeper view of what customers need. This lets banks adjust their services in more useful ways. Such knowledge makes the relationship between financial organizations and their clients better, leading to longer-lasting interactions.

- Data-Driven Decisions: AI enhances the ability to make informed decisions based on comprehensive data analysis.

- Scalability: Financial institutions can scale their operations more efficiently with AI, handling increased customer demands without sacrificing service quality.

Enhancing Customer Interactions

One of the main benefits of AI in finance is its capability to improve communication with customers. Banks can give quick answers to customer questions by using chatbots and virtual assistants powered by AI, enhancing reply times and accessibility. These systems manage ordinary inquiries, letting human representatives concentrate on more intricate problems. Additionally, AI can study customer engagements to detect regular worries and sectors for enhancement. This constant cycle of feedback lets financial businesses polish their offerings, turning them more user-oriented and efficient.

Besides chatbots, AI systems can provide active help by guessing customer requirements from past communications. Banks can improve client satisfaction and loyalty with this forward-thinking style, foreseeing problems before they occur. This method results in an uninterrupted experience where clients sense their importance and comprehension.

- Proactive Solutions: Anticipating customer needs can lead to higher satisfaction and loyalty through timely interventions.

- Feedback Utilization: Continuous analysis of interactions helps refine customer service strategies and improve overall service delivery.

Personalized Banking Solutions

The ability of AI to handle big data allows banks and financial organizations to give customized banking solutions designed for the unique needs of each customer. By studying customer actions as well as transaction histories, AI can suggest products and services that match their likes. For example, AI systems may recommend personalized investment possibilities depending on a client's risk level or even offer monetary guidance according to spending patterns. This degree of customization not only improves the happiness of customers but also creates loyalty because clients believe their banks understand and appreciate them.

Personalization is also applicable to marketing techniques where AI can adjust communications depending on personal choices. This focused strategy enhances interaction rates because customers have a higher chance of reacting to offers that match their specific financial plans. Banks, by using personalization effectively, can form a more significant connection with their customers.

- Targeted Marketing: Personalization in marketing communications leads to higher engagement and conversion rates.

- Client Retention: Satisfied customers are more likely to remain loyal and recommend services to others, driving growth.

Risk Management and Fraud Detection

AI has an important function in enhancing risk control and identifying fraud within financial services. Algorithms of machine learning can review transaction trends instantly, highlighting irregularities that could show fraudulent behavior. Utilizing data from past events, AI apparatuses can forecast possible hazards and evaluate the chances of loan or investment defaults. This active strategy not only defends monetary organizations from substantial losses but also guards clients by making sure their details and money are safe.

When we put AI into systems for detecting fraud, it can help us find suspicious activity much faster. Because of this quickness in response made possible by AI, losses are prevented before they become bigger and customers' trust is kept. These structures which learn from new data constantly improve their ability to spot fraudulent behaviors more efficiently.

- Real-Time Monitoring: AI enables continuous monitoring of transactions, which helps in the swift identification of fraudulent activities.

- Adaptive Algorithms: Machine learning models improve over time, adapting to new fraud patterns and emerging threats.

Improving Operational Efficiency

AI usage in finance does not only improve customer applications but also increases work effectiveness. Automatic performance of normal tasks such as entering data and matching it assists banks in using their resources better. AI can make processes like approving loans and checking credit much quicker, thus reducing the time needed for these activities greatly. This effectiveness turns into quicker service provision for clients, who gain from decreased waiting periods and enhanced access to financial items.

Moreover, the capacity of AI to handle numerous data swiftly can improve regulatory adherence. Through automation in compliance check-ups and documentation, financial organizations have a chance to lessen error probability and secure obeisance towards regulations, finally preserving both time and resources while boosting accuracy.

- Cost Reduction: Automation of repetitive tasks leads to significant cost savings in operational expenses.

- Regulatory Adherence: AI helps ensure compliance with regulations by streamlining reporting processes and monitoring.

Future Trends in AI and Customer Experience

With the ongoing progression of technology, it seems that AI plays an encouraging role in finance's future. Current indications point towards a rising dependence on AI for predictive analysis which can give an understanding of market inclinations and client tendencies. It is reasonable to assume that financial organizations will embrace more advanced solutions powered by AI, as this improves their capacity to deliver tailored services. Moreover, merging AI with different technologies like blockchain might revolutionize financial services more. It can offer customers systems that are safer and function better.

In the future, moral thoughts connected to AI will gain more significance. As monetary organizations gather more data for improving their AI structures, they must keep up and respect customer privacy. It's very essential to strike a balance between innovation and ethical methods as this plays an important role in creating trust and guaranteeing lasting victory.

- Ethical Standards: Implementing robust data protection measures is essential for maintaining customer trust.

- Innovation Balance: Financial institutions should strive to innovate while ensuring compliance with ethical guidelines and regulations.

Conclusion

To conclude, AI is becoming more important in bettering customer experience in the financial industry. By offering tailored banking solutions, superior interaction, and advanced security, AI is changing how customers interact with their banks. As this technology keeps progressing, it's obvious that the financial future will rely on its capacity to utilize AI efficiently to cater to the ever-changing needs of customers.

-

Business Sep 29, 2024

Business Sep 29, 2024Strategies for Online Business Growth

Uncover key strategies to enhance your online business growth and effective digital marketing techniques.

-

FinTech Oct 24, 2024

FinTech Oct 24, 2024Revolut's New Banking Era: What the License Means for Digital Banking

UK fintech firm Revolut secures its European banking license, allowing it to expand services across Europe. Discover how this milestone reshapes the company's future in digital banking

-

Business Sep 02, 2024

Business Sep 02, 2024From Seed to Success: The Role of Series A, B, C and D in Startup Growth

This article explores the various funding stages of startups, from seed funding through Series D, highlighting their purposes, benefits, and strategies for success.

-

Business Sep 02, 2024

Business Sep 02, 2024Ohio Payroll Guide: Employer's Step-by-Step Process for 2024

According to the Ohio payroll book rules, corporations must pay workers every two months. Deductions from salary are legal.