Help you understand crypto assets

Jan 13, 2024 By Ken Becher

The concept of ICO originated from crypto assets (digital coins and symbols) in the operation center. Like physical currency, crypto assets are scarce and its control power is transferable. However, while physical coins are transmitted face-to-face (or human and machine), the control change of crypto assets need to be realized through the carrier of the network (through the transmission of digital keys). A crypto asset is nothing but an entry on the distributed ledger. It appoints a specific user identified by a “private key” (essentially a specific password), who is the only person who can exercise a set of discrete powers associated with the entry on the distributed ledger. Although the private keys may be passed directly in the physical world, the actual crypto asset is destined to be only a general ledger entry, which is always locked in its “local” protocol.

The history of crypto assets started from Bitcoin and Bitcoin distributed ledgers (also known as “blockchains”). Before the advent of money, currency did not exist in physical form (such as coins or paper money), but in the form of a ledger of centralized intermediaries (such as bank deposits or PayPal balances). Bitcoin is the first important digital currency system, which does not require a centralized intermediary to maintain proper ledgers. The key to the design of the distributed ledger and the design based on the public blockchain system is how it maintains a reliable record of ownership. The Bitcoin ledger is not concentrated in one company, but is copied and broadcasted through a computer network that communicates with the Internet. These computers are called “nodes”. When a Bitcoin holder broadcasts information to a network node to transfer some Bitcoin to another user, the transaction subject does not need to rely on the credibility of any actor in the system to properly modify its copy of the ledger. Instead, they rely on economic incentives and code based control to manipulate nodes, which ensures that all copies of the ledger are updated the same.

-

FinTech Sep 22, 2024

FinTech Sep 22, 2024Ola Electric: SoftBank-Backed Indian EV Startup's $4.8B Debut

SoftBank-funded Indian EV firm Ola Electric grew 20% on its first day, achieving a total net worth of almost $4.8 billion.

-

Currency Oct 21, 2024

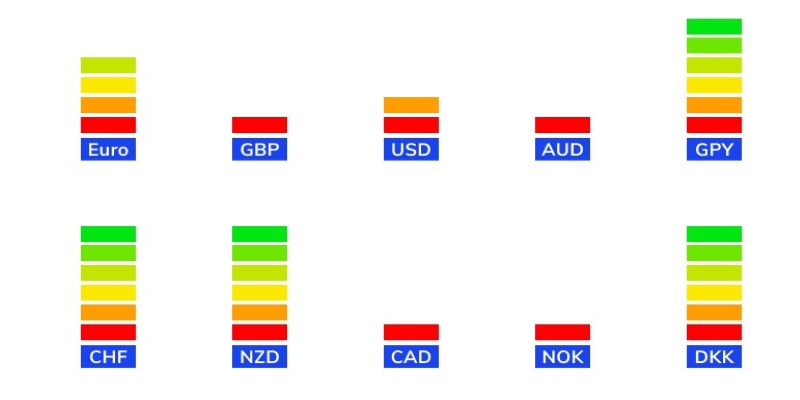

Currency Oct 21, 2024Forex Made Simple: How to Harness the Power of a Currency Strength Meter

How to use a currency strength meter to improve your Forex trading. Discover the tool’s benefits, how it works, and practical tips for incorporating it into your strategy

-

Business Sep 02, 2024

Business Sep 02, 2024A Beginner's Guide to Cooperatives: Everything You Need to Know

This article explores the benefits, establishment, governance, and challenges of cooperatives, highlighting their role in promoting economic empowerment and community development.

-

Currency Jan 09, 2024

Currency Jan 09, 2024What is Accounts Receivable Financing?

Accounts receivable financing is the agreement that allows business owners to access financing capital related to their accounts receivable. AR Financing agreements can be structured with asset sales or loans. This financing business is a great way to free up the business's cash flow, tied up by unpaid invoices.